Bajaj Housing Finance Limited IPO Details:

IPO Date: September 9, 2024 to September 11, 2024

Total Issue Size: ~93.71 Cr shares

Fresh Issue: ~ 50.86 Cr shares

Offer for Sale: ~ 42.86 Cr shares

Price band: Rs. 66 – Rs. 70 per share

IPO Issue Size: ~ Rs. 6,560 Cr

Lot Size: 214 shares and multiples thereof

About Bajaj Housing Finance Ltd Company

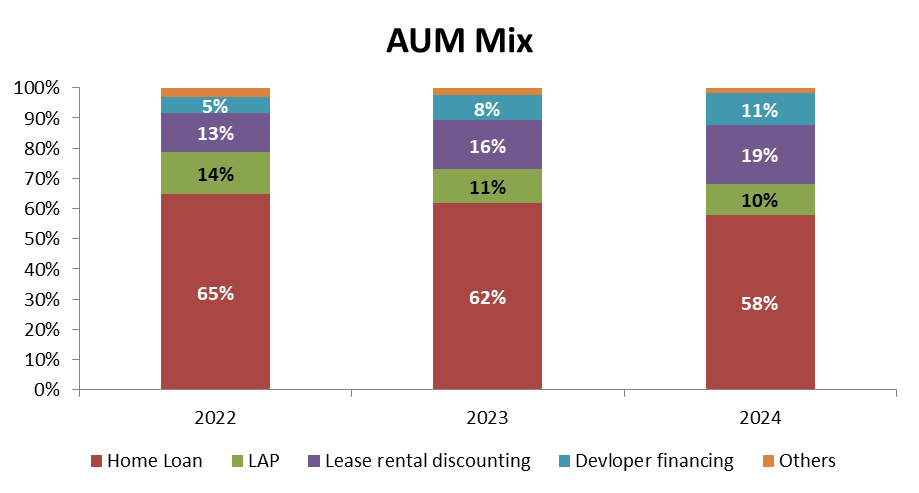

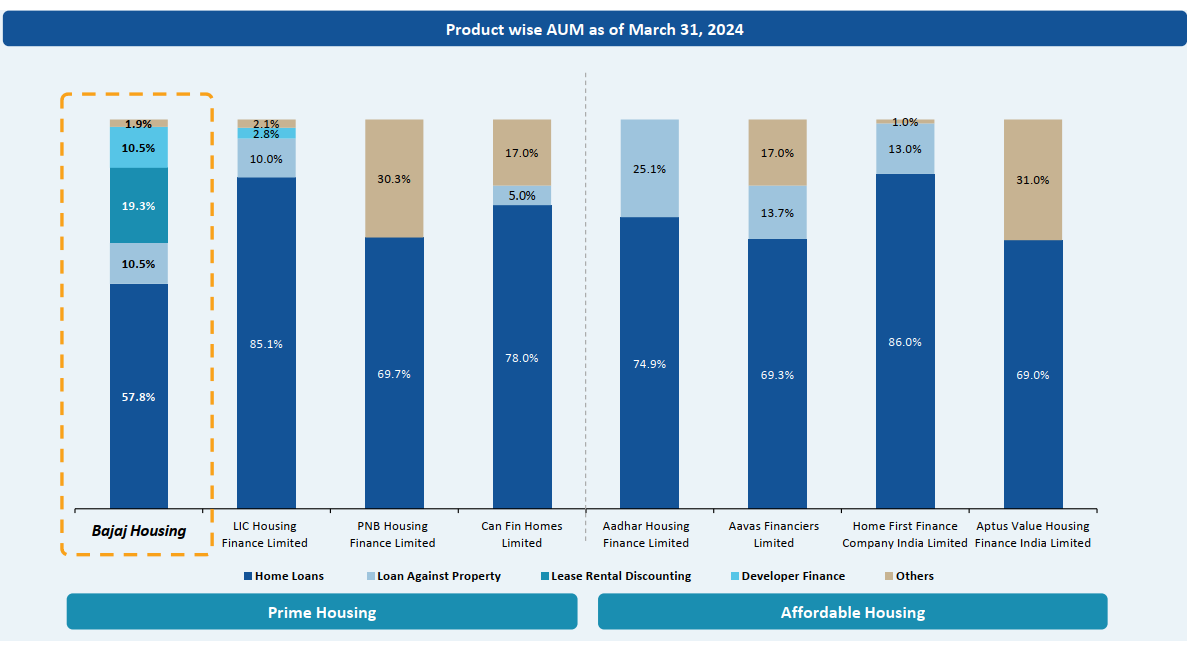

Founded in 2008, Bajaj Housing Finance is a non-deposit-taking Housing Finance Company (HFC) registered with the National Housing Bank (NHB) since 2015 and has been offering mortgage loans since the financial year 2018. The company is part of the Bajaj Group, a diversified group of companies with interests in various sectors. Bajaj Housing Finance provides customized financial solutions to individuals and corporates for the purchase and renovation of homes and commercial spaces. The company's product range is comprehensive and includes (i) home loans, (ii) loan against property (LAP), (iii) Lease rental discounting, and (iv) Developer financing. Bajaj Housing Finance is the second largest HFC with assets under management of Rs 91,370 Cr as of FY 2024 and the fastest growing HFC with a CAGR of 29.3% between FY 2020-24. LIC Housing Finance is the largest housing finance company in India with a total loan portfolio of ~Rs. 2,87,000 Cr in FY24.

Key growth drivers for housing finance

As per the report of the RBI-appointed Committee on the Development of the housing finance securitization market (September 2019), total incremental housing loan demand, if this entire shortage is to be addressed, is estimated to be in the region of Rs. 50 lakh Cr to Rs. 60 Lakh Cr as per the Committee report. In comparison, the overall housing loans outstanding (excluding PMAY loans) as of March 2023 is around Rs. 28.7 Lakh Cr. This indicates the immense potential of the market.

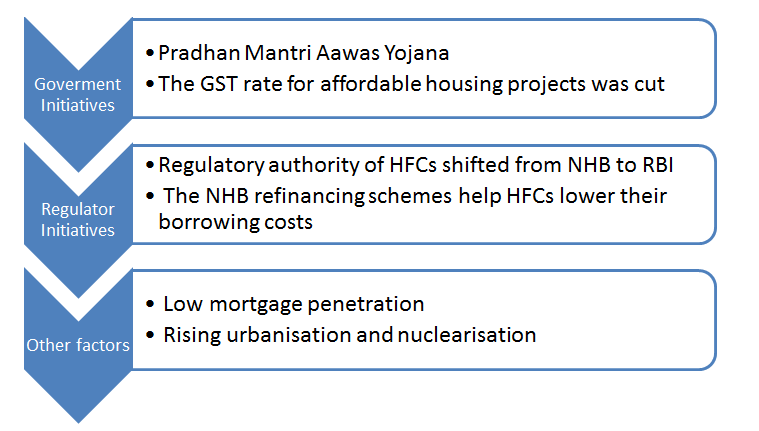

Other factors that will enable housing demand-

Housing Finance Market In India

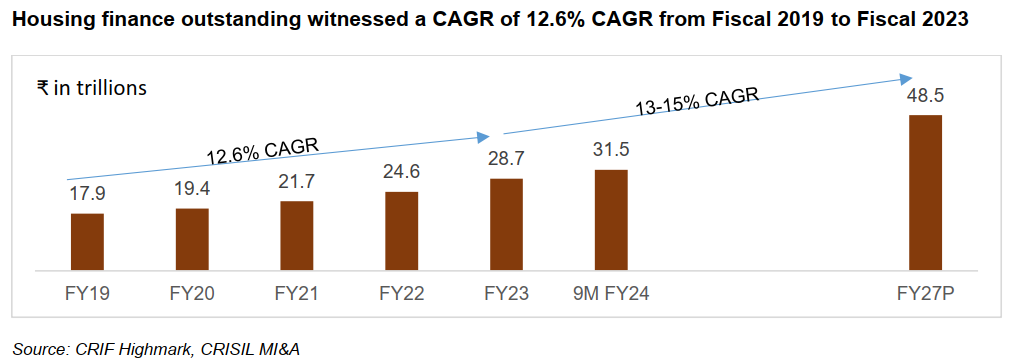

Housing Finance Companies (HFCs) play a crucial role in India's financial system, providing essential funding to the housing sector. The Indian housing finance market clocked a healthy ~12.6% CAGR (growth in credit outstanding) from FY19 to FY23, on account of a rise in disposable incomes, healthy demand, and a greater number of players entering the segment. The overall housing finance segment credit outstanding is approximately Rs. 28.7 Lakh Cr as of FY23 (YoY growth of 16.7%).

According to the Industry report overall housing segment is expected to grow at a CAGR of 13-15% from FY23 to FY27.

Market Segment:

The Housing Loan market can be segregated into Lender Type and customer profile:

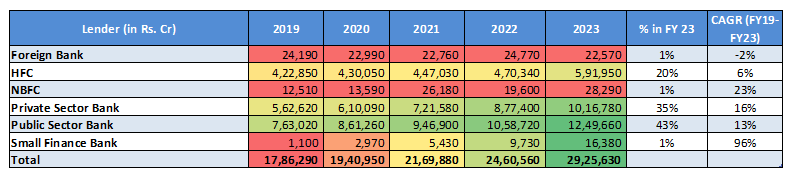

Across lender type (Banks/HFCs): As at December 31, 2023, public sector banks accounted for the highest share in overall housing credit ~43% which was followed by Private Sector banks with ~36% share and Housing Finance companies with ~19% share. During FY19-23, among major lenders Private Sector banks witnessed the fastest growth in housing finance credit with a CAGR of 16%, followed by public sector banks with 13% CAGR during FY19 to FY23 and housing finance companies with 10% CAGR.

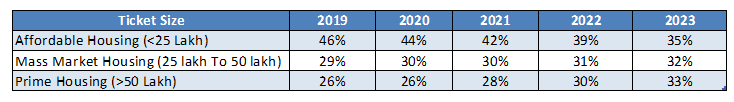

Customer profile (Mass-market/Affordable/Prime): Prime housing segment (Loans above Rs.50 lakh) witnessed the fastest growth from FY19 to FY23, growing at a CAGR of 19.5% which was followed by loans in the mass-market housing segment (loans between Rs.25 Lakh to Rs.50 Lakh) which grew at a CAGR of 15.9% and affordable housing (loans less than Rs.25 Lakh) growing at a rather slow pace of 5.6% during the fiscal.

Market share for ticket brackets, in value terms was equally distributed as at December 31, 2023, with both affordable and prime housing segments accounting for 34% market share each and mass market housing with a 32% share in overall housing.

Business Model

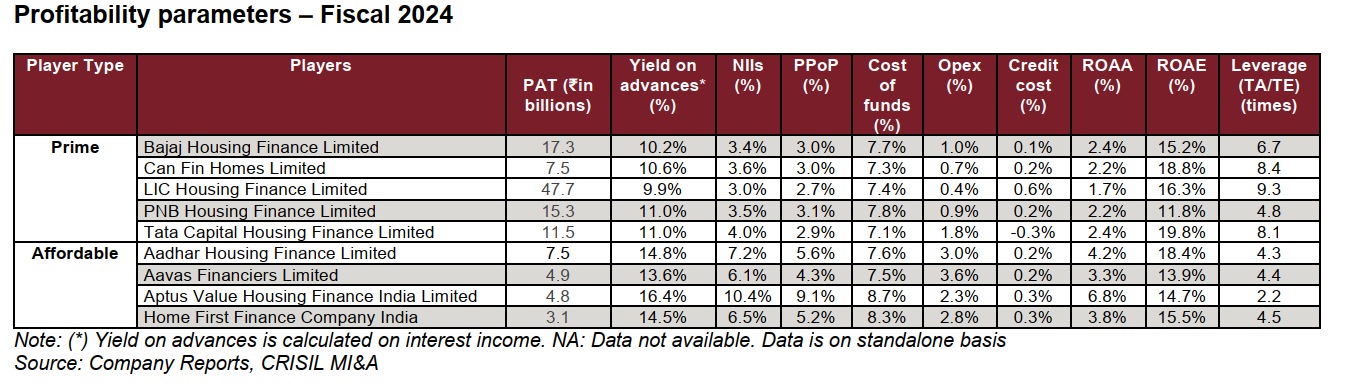

HFC’s leverage is a function of its business mix, growth potential, delinquency trends and portfolio concentration among other factors. While relatively higher leverage is acceptable for granular and stable products like prime retail home loans, a lower leverage may be warranted for portfolios which are either more concentrated (e.g., Corporate or builder loans, high-ticket LAP) or the ones which exhibit relatively higher risk of delinquencies.

Housing Finance Companies in the prime housing segment generally earn a ROA of ~2% compared to affordable housing where the ROA can go up to ~4%. Lower ROA in the prime housing segment is offset by higher leverage as asset quality is good compared to the affordable housing segment.

Asset quality is a critical parameter while assessing HFCs. It is dependent on the portfolio mix of the HFC. In view of the high competition from the banking sector in prime housing/salaried segment and to improve profitability, HFCs focus on various other borrower segments (LAP, builder financing). Such loans exhibit greater credit risk and are priced higher vis-à-vis prime housing loans. Apart from housing loans, HFCs also extend LAP and real estate construction loans which exhibit different risk behavior. The overall asset quality of HFCs is assessed by evaluating the product-segment-wise exposures.

Among the peers, Bajaj housing finance has the highest ROA supported by low credit cost which shows a strong underwriting standard. Notably, within housing loans, the company has focus on customers having CIBIL score of 750+ (75.8% of home loan AUM) with salaried, self-employed professionals and self-employed non-professionals forming 87.5%,4.3% and 8.2% of home loan AUM respectively.

Moving ahead, BHFL plans to increase its market share through deepening relationships with existing customers, onboarding new customers and expanding to newer geographies to build a granular portfolio with reduced concentration risk.

Objective of the offer

The issue is a combination of a fresh issue of 50.86 Cr shares aggregating to Rs 3,560 Cr and offer for sale of 42.86 Cr shares aggregating to Rs 3,000 Cr. Bajaj Housing finance will be utilizing the Net Proceeds from the fresh issue towards increasing the capital base to meet future business requirements.

Management

Sanjivnayan Bajaj is the Chairman and a Non-Executive Director of the Company. He has more than 27 years of experience in various areas including business strategy, marketing, finance, investment, audit, legal and IT-related functions in the auto and financial services sectors.

Atul Jain is the Managing Director of the Company. He holds a bachelor’s degree in commerce (honours in accounting) and a master’s degree in business administration, each from Punjabi University, Patiala. He has over 24 years of experience in the financial, investment banking and retail finance sectors and was previously associated with PNB Capital Services Limited as a project executive and with Prudential Capital Markets Limited.

Rajeev Jain is the Vice Chairman and Non-Executive Director of the Company. He holds a post-graduate diploma in management from the T.A. Pai Management Institute, Manipal and has more than 30 years of experience in the consumer lending industry.

MoneyWorks4me Opinion

The housing finance industry in India is highly competitive, with various players, including other HFCs, NBFCs, and scheduled commercial banks, vying for market share. Industry reports indicate that the overall housing segment is projected to grow at a CAGR of 13-15% from FY23 to FY27. Bajaj Housing Finance stands as the second-largest HFC, boasting assets under management of Rs. 91,370 Cr as of FY24, and is the fastest-growing HFC with a remarkable CAGR of 29.3% between FY20 and FY24. Lower credit cost is a demonstration of its stringent underwriting standards, comprehensive monitoring, and prudent risk management practices. The company benefits from strong brand recognition and a proven track record of execution. At the upper price band, Bajaj Housing Finance commands a valuation of approximately 4x Price to Book for an ROE of 15%, suggesting that significant growth expectations are already factored into the price.

We recommend aggressive investors consider subscribing for potential listing gains.

Bajaj Housing Finance Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | September 09, 2024 |

| IPO Close Date | September 11, 2024 |

| Basis of Allotment Date | September 12, 2024 |

| Refunds Initiation | September 13, 2024 |

| A credit of Shares to Demat Account | September 13, 2024 |

| IPO Listing Date | September 16, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 214 | Rs. 14,980 |

| Maximum | 13 | 2782 | Rs. 194,740 |

Bajaj Housing Finance Limited IPO FAQs:

When will the Bajaj Housing Finance Ltd IPO open?

Bajaj Housing Finance Ltd IPO will open for subscription on Monday, 9th September 2024, and closes on Wednesday, 11th September 2024.

What is the price band of Bajaj Housing Finance Ltd IPO?

The price band for Bajaj Housing Finance Ltd IPO is Rs. 66-70/share.

What is the lot size for the Bajaj Housing Finance Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 214 shares, up to a maximum of 13 lots i.e. Rs. 1,94,740/-.

What is the issue size of Bajaj Housing Finance Ltd IPO?

The total issue size is ~ Rs. 6,560 Cr.

When will the basis of allotment be out?

Allotment will be finalized on September 12th and refunds will be initiated by September 13th. Shares allotment will be credited in Demat accounts by September 13th.

What is the listing date of Bajaj Housing Finance Ltd’s IPO?

The tentative listing date of the Bajaj Housing Finance Ltd IPO is September 16th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Download APP

Download APP

Comment Your Thoughts: